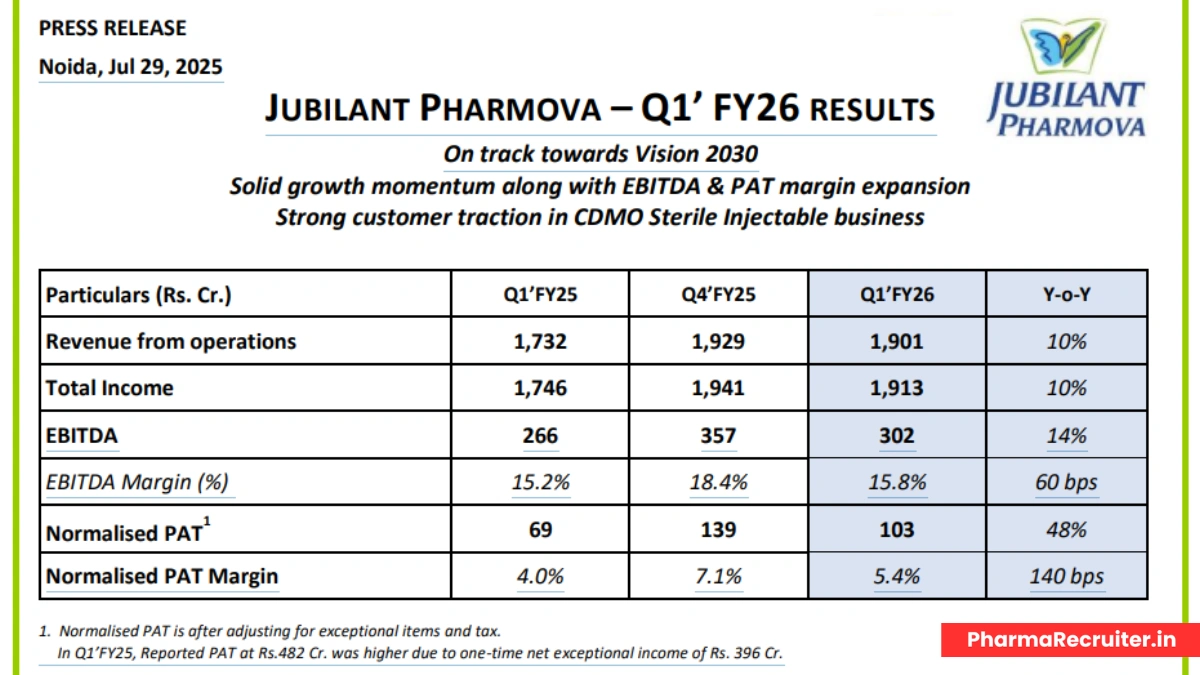

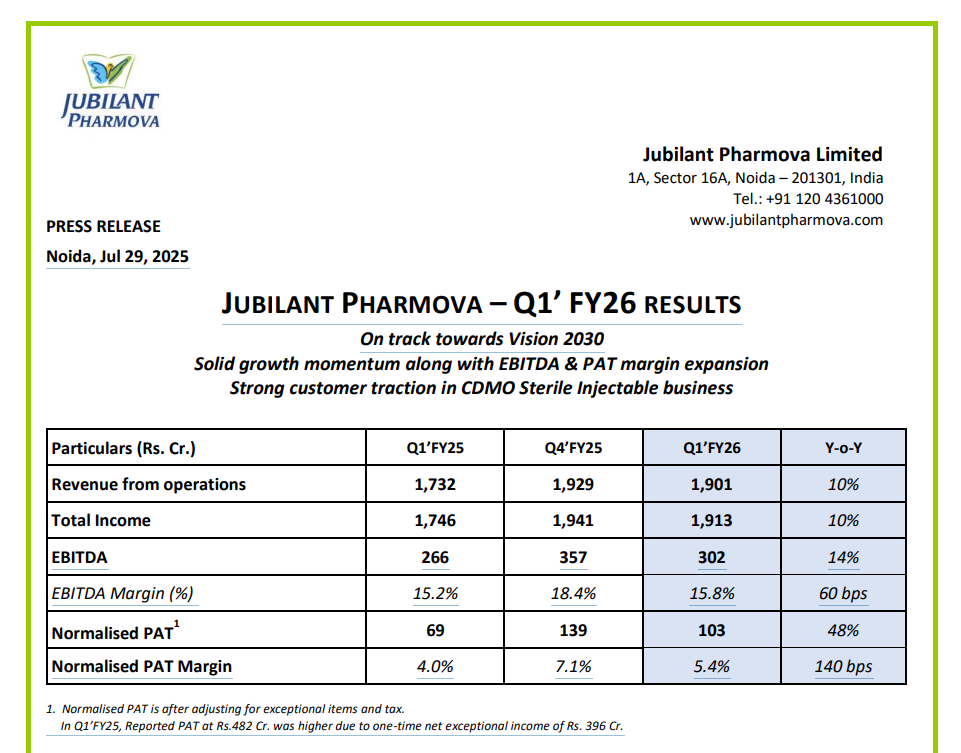

Jubilant Pharmova Limited announced its Q1’FY26 financial results, showcasing robust growth and strategic progress. With a 10% revenue increase and significant margin expansion, the company is on track to achieve its Vision 2030 goals.

Contents

Financial Performance Highlights

Jubilant Pharmova reported a revenue of Rs. 1,901 Cr. in Q1’FY26, marking a 10% year-on-year (YoY) growth. EBITDA rose by 14% to Rs. 302 Cr., with margins improving by 60 basis points to 15.8%.

Key Financial Metrics

| Particulars (Rs. Cr.) | Q1’FY25 | Q4’FY25 | Q1’FY26 | Y-o-Y |

|---|---|---|---|---|

| Revenue from Operations | 1,732 | 1,929 | 1,901 | 10% |

| Total Income | 1,746 | 1,941 | 1,913 | 10% |

| EBITDA | 266 | 357 | 302 | 14% |

| EBITDA Margin (%) | 15.2% | 18.4% | 15.8% | 60 bps |

| Normalised PAT | 69 | 139 | 103 | 48% |

| Normalised PAT Margin | 4.0% | 7.1% | 5.4% | 140 bps |

Note: Normalised PAT adjusted for exceptional items and tax. Q1’FY25 Reported PAT was Rs. 482 Cr. due to a one-time net exceptional income of Rs. 396 Cr.

Strategic Business Updates

Jubilant Pharmova’s diversified portfolio across Radiopharma, CDMO Sterile Injectables, and Generics drove solid performance. The company continues to invest in future growth, with Net Debt/EBITDA slightly increasing to 1.2x.

Segmental Performance

Radiopharma: Leading the US Market

- Revenue Growth: 3% YoY to Rs. 271 Cr.

- Key Developments: Ruby-Fill® installations expanded, with new PET and SPECT products planned for FY27–FY29. Phase 2 trial dosing for MIBG completed, with FDA submission targeted for H2’FY26.

- Radiopharmacy: Revenue up 5% YoY to Rs. 598 Cr., with two PET radiopharmacies distributing PYLARIFY®.

Allergy Immunotherapy: Expanding Market Presence

- Revenue Growth: 8% YoY to Rs.Offers competitive salaries and benefits for roles in pharmaceutical research, manufacturing, and more. Explore opportunities at Jubilant Pharmova Careers.

CDMO Sterile Injectables: Strong Customer Traction

- Revenue Growth: 14% YoY to Rs. 370 Cr.

- Key Developments: Line 3 in Spokane completed media fills, with commercial production set for FY26. Strong RFP traction from Big Pharma.

- Outlook: Peak utilisation for Line 3 expected in three years.

CRDMO: Integrated Drug Discovery Leader

- Drug Discovery Revenue: 42% YoY growth to Rs. 161 Cr.

- API Business: Revenue up 9% to Rs. 141 Cr., with EBITDA margins improved by 310 bps.

- Strategic Move: Proposed transfer of API business to Jubilant Biosys Limited for enhanced efficiency.

Generics: Profitable Growth

- Revenue Growth: 7% YoY to Rs. 166 Cr.

- EBITDA Margin: Improved by 1,400 bps due to focus on profitable products.

- Expansion Plans: Launching 6–8 products annually in US and non-US markets.

Proprietary Novel Drugs: Advancing Clinical Trials

- Progress: Phase II trial for JBI-802 and Phase I trial for JBI-778 actively enrolling patients.

- Focus: Developing breakthrough therapies in oncology and autoimmune disorders.

Leadership Commentary

Mr. Shyam S. Bhartia, Chairman, and Mr. Hari S. Bhartia, Co-Chairman, stated, “Our 10% revenue growth and 48% normalised PAT increase reflect strong performance across all business units. We are strategically investing in Radiopharma, CDMO, and CRDMO to ensure sustained growth.”

Jubilant Pharmova Q1’FY26 Results Press Release

Join Our Team

Jubilant Pharmova is hiring talented professionals to drive innovation in pharmaceuticals. Explore rewarding career opportunities in Radiopharma, CDMO, and more at Jubilant Pharmova Careers.

Contact Information

- For Investors: Pankaj Dhawan, +91 120 436 1105, Pankaj.dhawan@jubl.com

- For Media: Sandipan Ghatak, +91-98107 76182, sandipan.ghatak@jubl.com

Disclaimer: Forward-looking statements involve risks and uncertainties. Actual results may differ from projections. Jubilant Pharmova assumes no obligation to update these statements.