COPENHAGEN, Denmark – Zealand Pharma A/S (NASDAQ:ZEAL), a key player in the biotechnology sector, has announced exceptional financial results for the first half of 2025. A landmark collaboration with Roche has driven a massive revenue surge and fortified the company’s leading position in the innovative peptide-based medicines market.

The company’s revenue reached an impressive DKK 9.1 billion, a significant increase from the same period last year. This growth is primarily attributed to a substantial upfront payment from its partnership with Roche. The operating result showed a remarkable turnaround to a profit of DKK 8,128 million.

Transformative Partnership with Roche

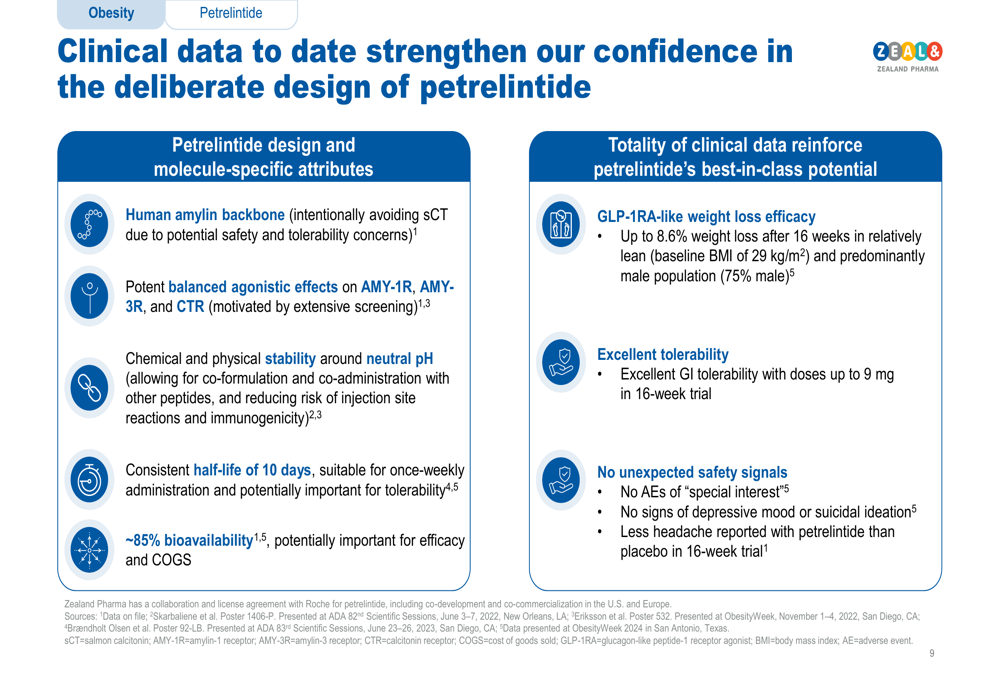

A pivotal development is the new alliance with global healthcare giant Roche. This collaboration centers on co-developing and co-commercializing petrelintide, a promising new treatment for weight management.

The agreement includes shared profits and losses in the U.S. and Europe. Zealand Pharma is also eligible for royalties on sales in other regions. This partnership is a strong validation of Zealand’s research and development capabilities.

Advancements in Obesity and Metabolic Disease Pipeline

Zealand Pharma is making significant strides with its robust pipeline of treatments targeting obesity and related conditions. The company is strategically positioned to address the growing global health challenge, with several key candidates progressing through clinical trials.

Key Pipeline Developments:

- Petrelintide (Amylin Analog): This once-weekly injection shows great promise for weight management. Following a successful Phase 1b trial, it is advancing rapidly through Phase 2 trials with partner Roche. Roche has already broken ground on a new manufacturing facility for next-generation obesity medicines.

- Survodutide (GLP-1/Glucagon Dual Agonist): In partnership with Boehringer Ingelheim, this candidate is in extensive Phase 3 trials. It has received Fast Track and Breakthrough Therapy designations from the U.S. FDA for treating MASH (metabolic dysfunction-associated steatohepatitis).

- Dapiglutide (GLP-1/GLP-2 Dual Agonist): Positive results from a Phase 1b trial showed significant weight loss. The company plans to initiate a Phase 2 trial in the latter half of 2025.

| Candidate | Mechanism | Partner | Current Phase |

| Petrelintide | Amylin Analog | Roche | Phase 2 |

| Survodutide | GLP-1/Glucagon | Boehringer Ingelheim | Phase 3 |

| Dapiglutide | GLP-1/GLP-2 | – | Phase 2b upcoming |

Strengthened Financial Position and Future Outlook

The first half of 2025 has been transformative for Zealand Pharma. The company’s cash position saw a substantial increase, rising to DKK 16.6 billion by the end of June 2025. This strong financial foundation allows for accelerated investment in its promising research pipeline.

Looking ahead, the company has a series of important milestones. Topline results for several key trials, including Phase 3 data for survodutide, are expected in early 2026. The company’s strong performance and advancing pipeline have drawn positive attention from the stock market, with analysts forecasting potential growth.

Note: Read the Zealand Pharma Announces Financial Results for the First Half of 2025

Zealand Pharma will share further insights at upcoming events, including Roche’s Pharma Day and its own Capital Markets Day in late 2025. These events will provide investors with deeper knowledge of the company’s strategy and pipeline.